With the automatic donation receipt from DonationsSwitzerland, donors can easily claim their tax deduction in Switzerland. It serves as a professional and time-saving template for nonprofits in Switzerland.

Donation receipt, donation confirmation, donation receipt, tax receipt: Many terms describe an important document in the donation process that can save donors a lot of money on their tax return. But what exactly is a donation receipt and what do donors and NPOs need to bear in mind?

What is a donation receipt?

A donation receipt is an official document issued by a charitable organization. It confirms that a person or company has made a donation.

In Switzerland, the exact form is not prescribed by law, but the information must be filled in credibly and completely by the NPO. The certificate normally contains

– Name and address of the donor

– Name and address of the organization

– Amount of the donation

– Date of the donation

– Purpose (if earmarked)

– Indication that the organization is tax-exempt

Why do I need a donation receipt?

In Switzerland, donations to tax-exempt organizations can be deducted from taxable income. Donors require the donation receipt as legally valid proof in order to to claim their tax deduction.

With a professionally issued certificate, NPOs not only strengthen the trust of their donors – they also increase the likelihood that they will receive repeat donations. If information is missing or inaccurate, tax offices will ask the NPO questions. Without a donation receipt, the tax office can refuse to deduct donations.

Which organizations allow donations to be deducted from tax in Switzerland?

In Switzerland, there are a number of criteria that allow donations to NPOs to be deducted:

– The organization must pursue charitable or public purposes.

– The organization must be tax-exempt in Switzerland.

– Many cantons require the organization to have its registered office in Switzerland.

You can check whether an organization is tax-exempt via the cantonal registers. To do this, check the tax register of the canton in which the organization is based. Donations to foreign organizations are only deductible in a few exceptional cases.

➤ Tip

All organizations on SpendenSchweiz are checked for their charitable status and are tax-exempt. You can make a donation to any of the NPOs listed and claim it on your next tax return.

How many donations can I deduct for tax purposes?

In the case of purely monetary donations, the amount of the deduction depends not only on your annual income, but also on your canton of residence. At federal level and in most cantons, you can claim 20 percent of your net income as a tax deduction for donations. A case study: At the end of the year, you still have CHF 20,000 net on your side. You can deduct donations of up to a maximum of CHF 4000 from your taxes.

In most cases, there is also a minimum donation of CHF 100 per year. It is not only the federal government and most cantons that insist on this rule. There are also some nonprofits that only issue a donation receipt above this minimum limit because it saves them administrative costs.

However, you can not only deduct monetary donations. You can also deduct donated real estate, securities or works of art for tax purposes as long as the value of the donation is correctly documented and you receive a corresponding certificate from the tax-exempt organization.

The most important rules for deducting donations

– Max. 20 % of net income (depending on canton)

– Minimum amount usually CHF 100 per year

– Applies to monetary donations as well as donations in kind (with documentation)

By when do I have to submit the certificate?

The donation receipt will be sent with the Tax return submitted. Accordingly, you must enclose the document as a PDF or printout by the regular deadline, depending on the canton, between February and April of the following year. It is usually possible to extend the deadline or submit the certificate to the tax office at a later date, but this will prolong the process.

It is therefore crucial for NPOs to issue the certificates to their supporters at the beginning of the year. This prevents a flood of support requests during this time and ultimately delays in the tax season.

How do I receive my donation receipt?

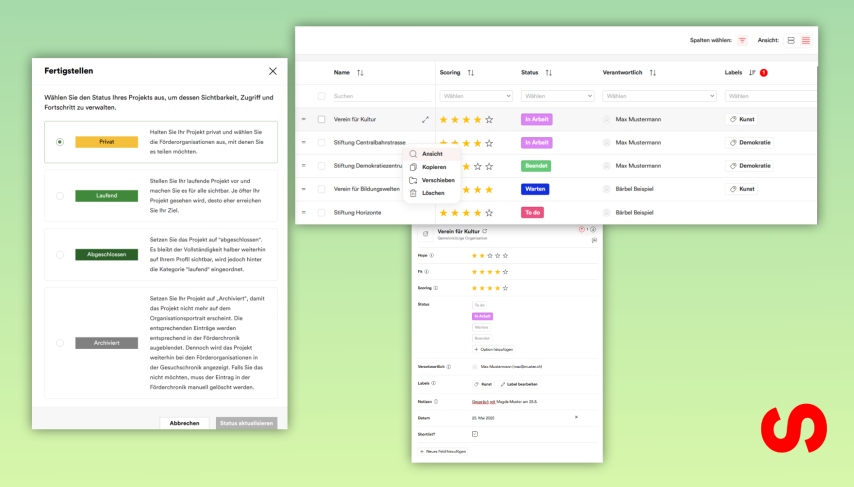

Normally, NPOs create donation receipts manually. They have to merge all donations from the various channels (bank, TWINT, website, events, etc.) and clean up the data. They then create the receipts and send them to the donors either by letter or email. In addition, there is the post-processing due to queries, adjustments or lost documents.

The administrative effort is very time-consuming and error-prone for most organizations. In many cases, donors often only receive their statement in the following year, sometimes even after the regular tax deadline. In the worst case scenario, they cannot claim their deduction for tax purposes. Not only does their trust in NPOs decrease, but often also the future volume of donations.

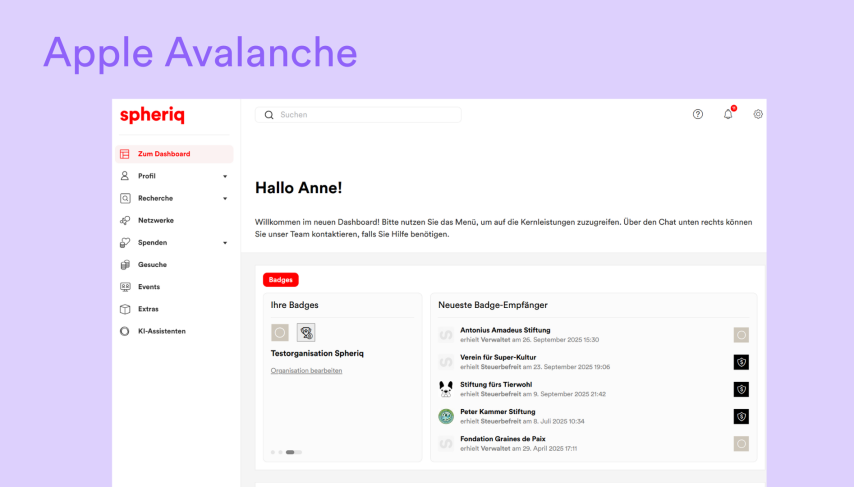

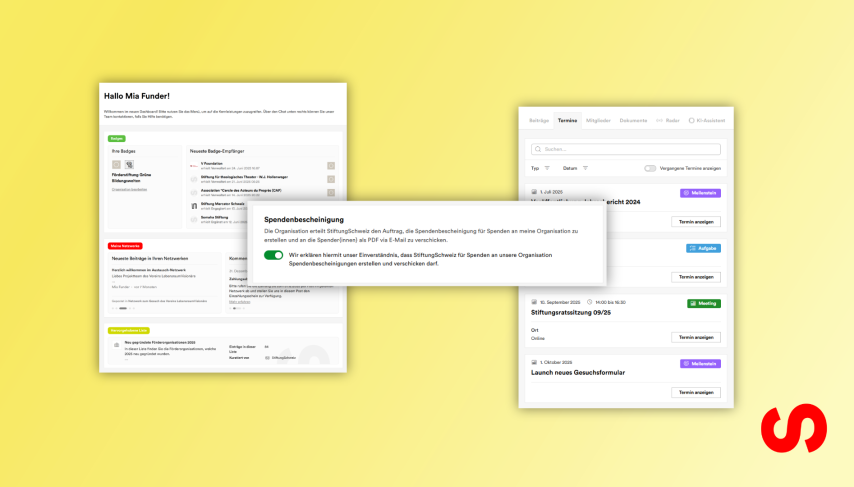

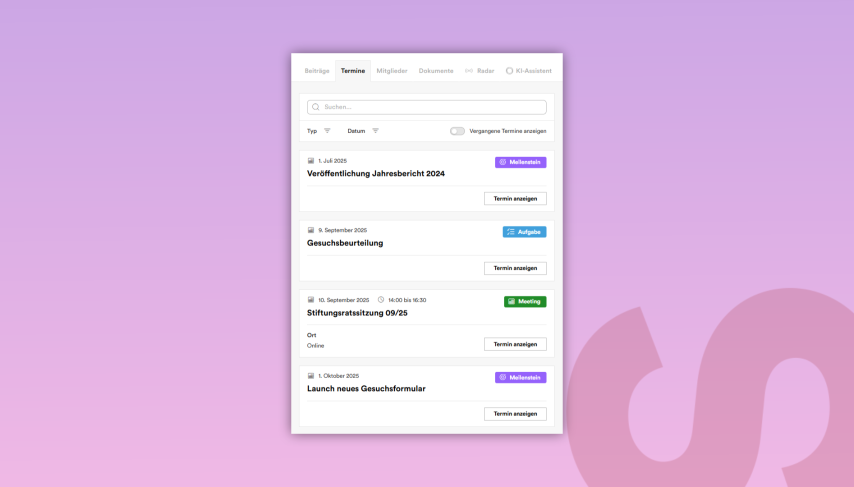

How does the automatic donation receipt work?

With SpendenSchweiz, NPOs and donors receive automatically generated, digital annual donation receipts. As there is no standardized template for donation receipts in Switzerland and Swiss nonprofits use different technical systems, the preparation of donation receipts is often confusing and overwhelming. Many NPOs do not have access to digital processes, which means that their donor data is often scattered or incomplete.

With the digital processing of donations and the automatic donation receipt, SpendenSchweiz reduces the workload for NPOs. All donations are correctly recorded, consolidated and documented throughout the year. Donors can find their donations in their profile at any time and can access the receipts directly. This also applies to annual collective receipts, i.e. summarized individual donations per charitable organization. At the same time, NPOs no longer have to prepare and send documents manually. This process significantly reduces support requests and the time required at the start of the year.

What are the advantages of the automatic donation receipt?

The automatic donation receipt from SpendenSchweiz simplifies the donation process for everyone involved. Both donors and organizations benefit from the digital solution in different ways:

For donors:

– No more tedious collecting of individual receipts.

– All receipts available digitally at any time.

– Donations for tax purposes are no longer forgotten.

– Documents can be attached directly to the tax return.

For organizations:

– Time savings in administration.

– Fewer errors thanks to automated data transfer.

– Professional and trustworthy appearance towards donors.

– More repeat donations through trust and convenience.

The donation receipt at a glance

The donation receipt is a key document for claiming donations for tax purposes in Switzerland. It confirms the donation to a tax-exempt and charitable organization and serves as proof for the tax authorities. With SpendenSchweiz’s automatic donation receipt, the entire process for donors and NPOs is digital, time-saving and error-free. Donors can keep track of their donations at all times, while organizations significantly reduce their administrative workload and at the same time promote trust and repeat donations.

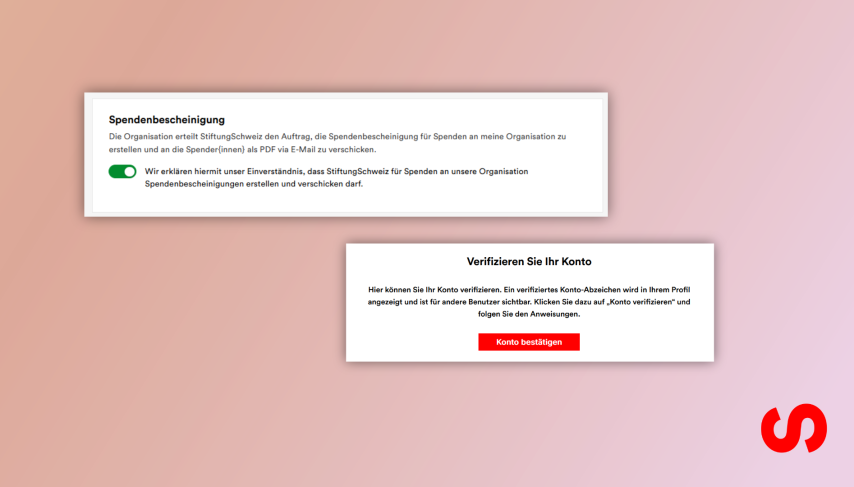

The automatic tax certificate is available to all tax-exempt nonprofit users from the Starter level upwards. If required, it can be deactivated at any time on the platform under “Bank info“.