Foundations today are feeling the increasing pressure to implement their asset investments in a more transparent, professional and impact-oriented manner. At the same time, digitalization is increasing the number of opportunities – and questions. The new webinar series “Digital investment” and a boot camp in January 2026 show how digital benchmarks, tools and a structured approach can support a modern investment policy.

Foundations bear a special responsibility – not only in their funding practices, but also in the way they invest their assets. This is where transparency, coherence and a consistent focus on the purpose are key. Andrea Studer, CEO of Fondation Botnar, puts it in a nutshell: “Responsibility is not limited to individual allocation decisions. It encompasses strategy, communication and investment policy in equal measure.”

Digital tools open up new opportunities to make this responsibility visible by making criteria, profiles and results comprehensible. And on the other hand, to regularly scrutinize current practice. However, tools cannot replace the basics: strategic clarity, clearly anchored regulations and a Board of Trustees that actively fulfills its steering role continue to form the foundation of professional asset management.

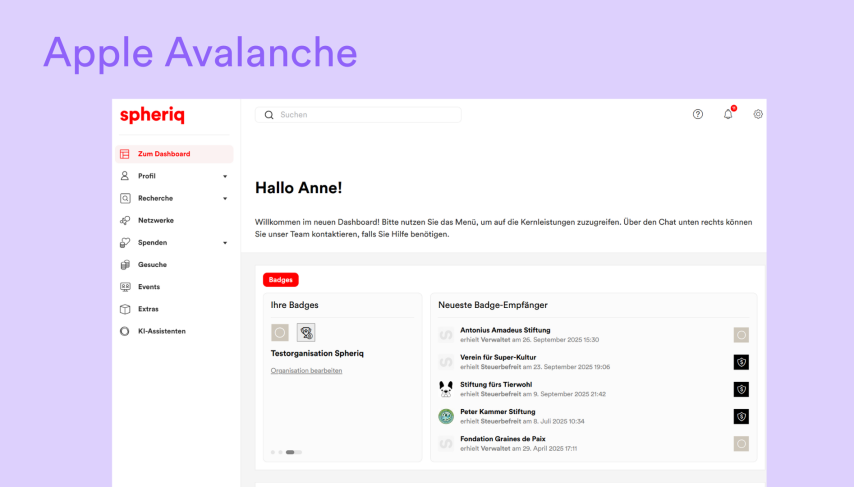

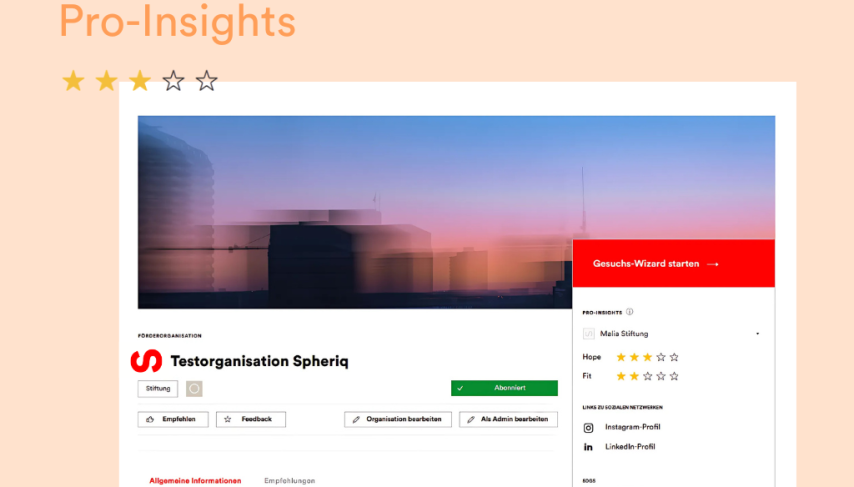

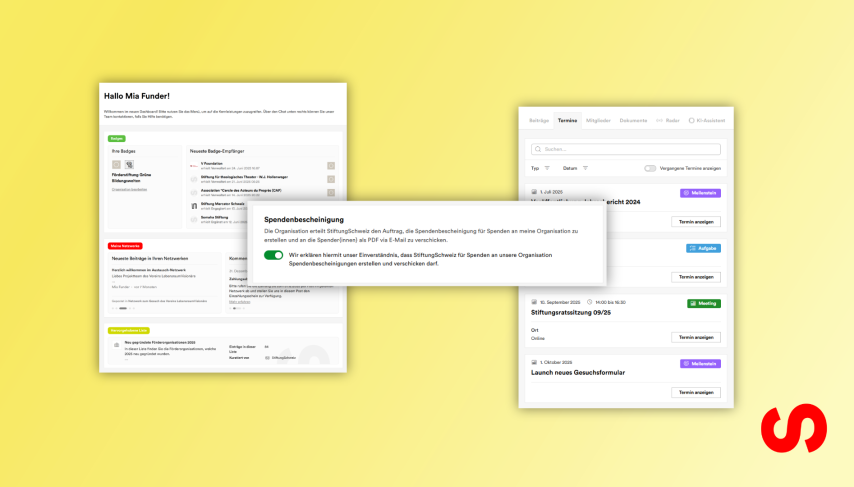

But what digital options are available today to support foundations in their work? This question is explored in the “Digital asset investment” focus, which Spheriq is offering to interested players in the non-profit sector together with partners from the end of November to mid-January.

Orientation through comparability

Many foundations are faced with the question of how they can meaningfully classify their investment results. Benchmarks make an important contribution here by making investment results comparable and making trends visible.

SwiPhiX creates a simple and solid basis for comparison. “SwiPhiX shows foundations where they stand in a market comparison – and creates transparency about performance and risk,” says Hansjörg Schmidt from Zürcher Kantonalbank. The SwiPhiX will therefore kick off the focus in the first webinar on November 25 from 3 to 4 pm.

But benchmarks are only part of the picture. The variance between foundation portfolios is remarkable, as Luzius Neubert from PPCmetrics knows:

In steps to the start

In the second session of the series on December 4, 11-12 a.m., the focus will be on implementation. How does a well thought-out strategy become a robust mandate? Many foundations face the challenge of consistently translating their objectives into regulations and a mandate that is both independent and cost-effective.

Olivier Fricker from FINAD emphasizes the importance of good support: “Foundations need personal advice that is independent, individual and long-term oriented.” Alexandra Janssen from ECOFIN adds to the perspective and shows how closely governance and investment strategy are linked: “Trends are important – but only a sound strategy ensures that investments sustainably support the foundation’s purpose.” Between regulations, tender and mandate, this creates the scope for foundations to act safely and consistently – both analog and digital.

In the digital age

A third focus and thus the topic of the concluding webinar on December 9, 9-10 a.m., is dedicated to digital tools. Today, they play a central role in controlling and reporting and help to structure complex information and make asset management transparent.

Ueli Mettler from c-alm classifies the development: “Investment advice on the threshold of digitalization? Partly yes, but there are limits.” In other words, digitalization can speed up processes and make data more accessible, in short: create an overview. But it cannot replace professional expertise.

Joël Escher from Kendris shows how tools can be used in practice. He is convinced: “Digital reporting makes asset management truly comprehensible.” Especially with heterogeneous portfolios, digital solutions prove to be a valuable support in everyday life and an important step if the investment of assets is not only to become an item on the agenda of the Board of Trustees meeting every few years.

Deepening in the boot camp

The bootcamp on January 14, 2026, 9 a.m. – 12 p.m. (also online) will bring together the topics of the series once again and add the central principles, governance aspects and legal framework that every foundation should know. In compact presentations, experts from the fields of consulting, asset management and law will shed light on how scope for action can be used and guidelines set.

Sebastian Rieger from proFonds aptly sums up the responsibility of the Board of Trustees: “When it comes to fulfilling the purpose and investing assets, the responsibility of the Board of Trustees is decided.” Anyone who looks at benchmarks, strategy issues and digital tools will gain a comprehensive understanding of what a modern investment policy can look like – and how the Board of Trustees can use digital tools to do its homework even more efficiently.

The combination of specialist input, practical insights and discussions in the boot camp creates a clear overall picture that helps participants to navigate the increasingly digital environment in a secure and purpose-oriented manner. This will be complemented by two practical examples of foundations that are already consistently aligning their investments with their purpose.

With these perspectives, the bootcamp not only shows where investment is heading in the digital age, but also how foundations need to find their own way – responsibly, purposefully and professionally. Those who know their scope of action and their toolbox well have an advantage – and this is exactly where the bootcamp wants to start.

Program and registration

Webinar 1 – Benchmarks & Performance

November 25, 2025, 3-4 p.m.

Compare, understand, improve: The webinar “Benchmarks & Performance”, part of our “Digital Investment” series, shows how foundations can correctly classify their investment results and draw strategic conclusions from them. Using SwiPhiX and other benchmarks, experts from Zürcher Kantonalbank and PPCmetrics will explain how benchmarks create transparency and strengthen the basis for decision-making. Find out what you can expect from a benchmark – and how to correctly assess the performance of your own investment strategy.

Webinar 2 – Steps to the mandate

December 4, 2025, 11 a.m. – 12 p.m.

Plan, implement, review: In the webinar “Steps to the mandate” in our “Digital investment” series, foundations learn how to transform their strategy into a professional investment concept – from defining the objectives to the regulations and the invitation to tender. Experts from FINAD and ECOFIN show what independence, cost efficiency and governance mean in practice. The webinar shows how clear structures and sound processes ensure the quality of investments in the long term.

Webinar 3 – Digital tools in controlling and reporting

December 9, 2025, 9-10 a.m.

How digital can asset investment be? The final webinar in our “Digital tools” series shows how foundations can use modern tools to create transparency and professionalize their asset management. Experts from c-alm and KENDRIS provide insights into current comparison, reporting and controlling solutions and discuss where digitalization brings real added value – and where its limits lie.

Bootcamp – Investing digitally

January 14, 2026, 9 a.m. – 12 p.m.

The digital investment bootcamp teaches foundations the key principles of responsible investment in one morning – in a compact, practical and (where possible) digitally supported format. You will learn how foundations can make strategic use of their scope for action, implement legal requirements and make targeted use of benchmarks. Experts will show how governance, investment regulations and reporting are interlinked – and which digital tools increase transparency and controllability. The compact boot camp provides orientation, pools experience and shows how foundations can use their assets professionally and purposefully in the digital age.

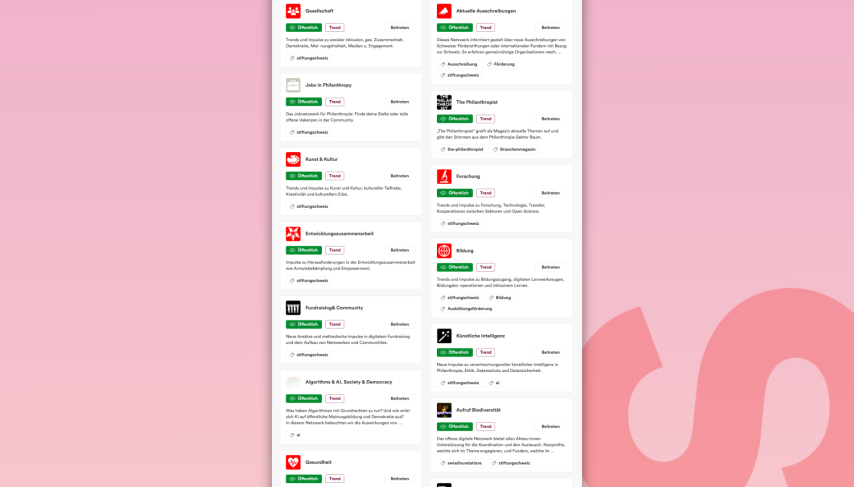

Trend Network “Investment & Finance ”

Exchange, discussions and in-depth discussions during and after the series

Between the end of November and mid-January, we invite you to become part of the Spheriq trend network “Investment & Finance” free of charge and benefit from the program: Understanding benchmarks, setting up mandates professionally, using digital tools sensibly – the foundations of an investment policy that takes responsibility seriously.